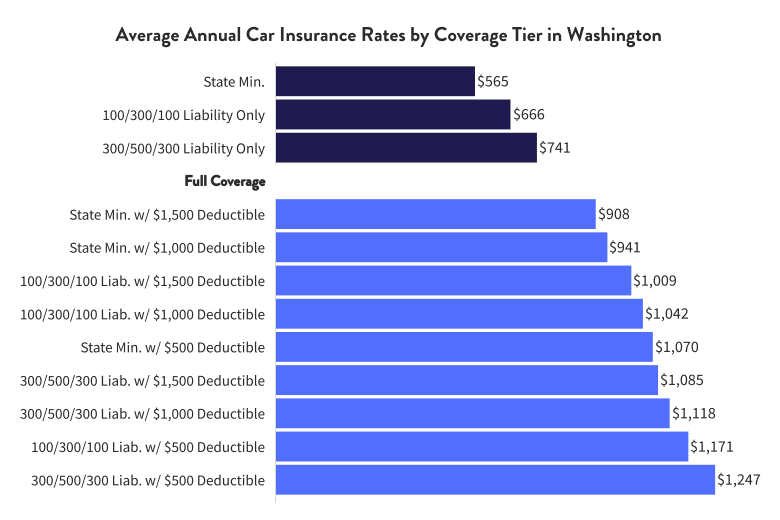

Figuring out why car insurance costs more in Washington can be a real head-scratcher for many people, even though the average yearly price of $1,264 is slightly lower than the national average. Getting car insurance in the Evergreen State might hit your wallet a bit harder. We’ll examine the major reasons and also delve into the personal factors that affect how much you pay.

Why Washington Car Insurance Is Expensive: State Level Factors

Packed Highways, Heavier Costs

Washington’s roads are bustling beehive, with more cars buzzing around than the average nationwide. There are about 8.3 million miles driven for every mile of highway! That’s a lot of people out there on the road. Now, when you pack so many cars into a limited space, the chances of them bumping into each other go up. Because of this increased risk of accidents in all that traffic, insurance companies have to charge more to cover the potential bumps and scrapes.

Urban Sprawl and Its Implications

In Washington, 84% of people live in cities and towns. That’s a whole bunch of people all close together. Now, when you pack a lot of homes and cars into one area, it can attract theft or vandalism. With so many people living close to Washington’s urban spots, insurance companies have to consider the higher chance of theft or vandalism happening to your car. That’s why they might ask for a bit more to ensure you’re covered in case of any mischief. Urban living is great but comes with a little extra on the insurance bill.

Unsettling Numbers of Uninsured Motorists

22% of drivers are cruising around without insurance, and that’s close to the national average. Now, why does this matter to you? Well, if you’re in a fenderbender with someone who doesn’t have insurance, it can complicate things. Insurance companies have to consider the risk of getting into a pickle with an uninsured driver; unfortunately, it can make everyone’s insurance bills a bit higher.

High Vehicle Theft Rates

In Washington, there are about 320.5 cars stolen for every 100,000 people. That’s a lot of missing cars, and it’s caught the attention of insurance companies. See, insurance companies take note when there’s a higher chance of your car going on an unscheduled joyride. They have to consider that extra risk, and unfortunately, that often means our insurance bills go up.

Natural Disasters

Washington state has faced a whopping 177 FEMA disaster declarations, more than double the usual nationwide. This isn’t just about history; it’s a wild card in the insurance game. When there’s a higher chance of natural disasters, like floods or storms, it means there’s also a chance of our vehicles getting caught up in the chaos.

The Personal Equation: Individual Factors

Geographical Gambles: Where You Live Matters

Let’s discuss where you live in Washington and how it can shake up your insurance bill. Take Tacoma, for example; living there means you might pay around $1,358 yearly for car insurance. Now, if you shift to Spokane, it’s lighter on the wallet, with an average of $1,050 per year. Depending on the neighbourhood, your insurance cost can be higher or lower. So, your geographic spot in Washington influences how much you pay for car insurance.

Age: The Cost of Experience

If you’re starting at 16, brace yourself. Your yearly insurance bill might hit around $2,731. That’s a hefty price tag for being a newbie on the road. Now, fast forward to when you’re a cool 40 year old. The good news is your annual insurance cost can chill out to a more manageable $1,264. When it comes to car insurance, age is a magic number that can make a big difference in how much you pay.

Driving History

Your driving history is a report card for insurance companies. It keeps track of everything you’ve done while driving. This includes any tickets you’ve gotten, accidents you’ve been in, and if you’ve ever been caught driving under the influence. Insurance companies look at this history to determine how risky you are as a driver. If you’ve been a safe driver with no major mishaps, it’s like getting a gold star. But getting coverage might cost you more if your history is filled with accidents and tickets.

Credit Scores and Car Choices: Financial and Vehicular Dynamics

Your credit score and the car you pick play a big role in how much you pay for car insurance. Insurance companies use your credit score to guess how responsible and stable you are with money. If your credit score is good, you usually get a pat on the back in the form of lower insurance costs. But if your credit score is just okay or not so great, your premiums might climb. Then there’s the car you choose. Fancy, high-performance cars or luxury rides can mean higher insurance bills. Why? Because fixing or replacing them is often more expensive. On the other side, if you go for an older, more budget friendly car, you’re likely looking at lower insurance costs. Understanding all of this is key for folks who want to save on insurance. It’s like putting together a puzzle your credit score, your wheels, and how much you pay for insurance all fit together. So, if you’re aiming to spend your money wisely, it’s smart to consider both your wallet and the wheels you’re rolling in.